If you’re an employee or employer in the United States, you’ve likely heard of the I-9 tax form. This form is an essential component of the tax filing process, and it’s crucial to understand its requirements and regulations.

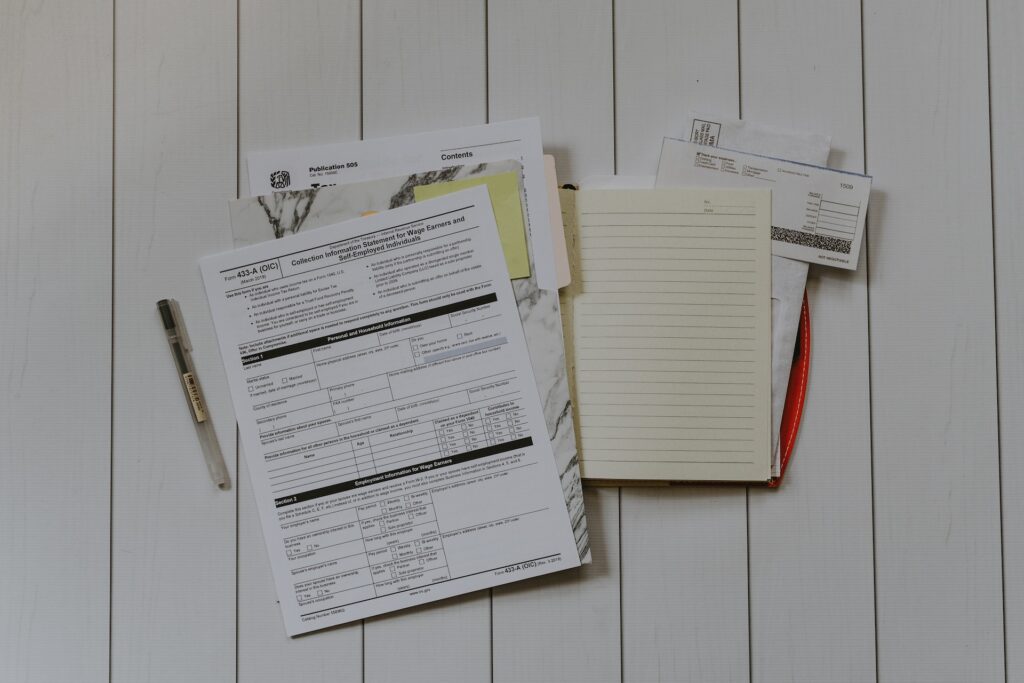

In this comprehensive guide, we’ll break down everything you need to know about the I-9 tax form. From its purpose and process to compliance requirements and record-keeping, we’ve got you covered. By the end of this article, you’ll have a clear understanding of the I-9 tax form and its significance in your tax filing process.

Key Takeaways

- The I-9 tax form is a crucial component of the tax filing process for employees and employers in the United States.

- Understanding the purpose of the I-9 tax form is essential to ensuring accurate and compliant filing.

- Meeting I-9 tax form requirements and adhering to regulations is crucial for avoiding penalties and maintaining compliance.

- Maintaining accurate I-9 tax records is essential for compliance and avoiding penalties.

- Maximizing your I-9 tax refund requires careful attention to eligible deductions and credits.

Understanding the Purpose of the I-9 Tax Form

When you start a new job in the United States, you’ll most likely have to fill out one or more tax forms, including the form I-9. The purpose of the I-9 tax form is to verify your eligibility to work in the U.S. This form is completed by both the employee and the employer and is required by federal law.

The I-9 tax form is important because it ensures that only individuals who are legally allowed to work in the United States are employed. This is critical for maintaining the integrity of the workforce and preventing undocumented workers from taking jobs that should be filled by legal residents and citizens. It also helps to protect employers from potential legal issues related to hiring unauthorized individuals.

It’s important to note that the I-9 tax form is not directly related to federal income tax. While the information provided on the form may impact your tax withholdings and filing status, the primary purpose is to confirm your eligibility to work in the country.

Navigating the I-9 Tax Form Process

Completing the I-9 tax form can be a complex process, but it’s essential to ensure compliance with federal regulations. Here’s a step-by-step guide to help you navigate it:

Step 1: Obtain the Form

The I-9 tax form can be found on the official website of the U.S. Citizenship and Immigration Services (USCIS). You can download it, fill it out electronically, or print it and complete it by hand. Be sure to use the most recent version of the form to avoid any errors or delays.

Step 2: Section 1 of the Form

The employee must complete section 1 of the I-9 tax form no later than the first day of employment. This section requires basic personal information, such as name, date of birth, and social security number. It’s essential to ensure that this section is completed accurately and in full.

Step 3: Section 2 of the Form

The employer must complete section 2 of the I-9 tax form within three business days of the employee’s start date. This section requires the employer to verify the employee’s identity and employment authorization by examining specific documents. The employer must also record the document’s information on the I-9 form.

Step 4: Section 3 of the Form

Section 3 of the I-9 tax form is only necessary if there are certain changes in the employee’s work status, such as a name change or employment authorization extension. Employers must update this section within 90 days of the noted change.

Step 5: Submitting the Form

Once the I-9 tax form is completed, the employer must retain it for three years after the employee’s date of hire or one year after the employee’s termination, whichever is later. The form may be subject to inspection by the USCIS and other regulatory agencies.

Maintaining Accurate I-9 Tax Records

Keeping accurate I-9 tax records is essential for compliance with tax regulations. As an employer, it’s your responsibility to maintain proper records for each employee. These records must be kept for a specific period, and accurate documentation is necessary in the event of an audit.

The I-9 tax records must be kept for at least three years from the date of hire or one year after the termination of employment, whichever is later. It’s crucial to retain these records for the required duration to avoid penalties and non-compliance issues.

The I-9 tax record-keeping requirements include the proper completion of the I-9 tax form, maintenance of corresponding documents, such as identification and work authorization documents, and proper archiving of records.

It’s essential to ensure that your I-9 tax records are up-to-date and organized. Any discrepancy or incomplete information can lead to compliance issues and potential consequences, such as fines and legal action. By keeping accurate records and complying with regulations, you can avoid any potential penalties and maintain a smooth sailing experience when filing taxes.

Maximizing Your I-9 Tax Refund

Once you’ve completed your I-9 tax form and ensured compliance with all the requirements, it’s time to focus on maximizing your tax refund. Here are some tips to help you get the most out of your I-9 tax filing:

- Explore all available deductions: Be sure to take advantage of all eligible deductions when completing your I-9 tax form. This includes deductions for charitable contributions, work-related expenses, and education expenses.

- Claim tax credits: Tax credits can significantly reduce your tax liability and increase your refund amount. Be sure to claim all eligible credits, such as those for child and dependent care expenses, education expenses, and energy-efficient home improvements.

- File electronically: Filing your I-9 tax form electronically can help expedite the processing of your return and may result in a faster refund.

- Review your return carefully: Before submitting your I-9 tax form, carefully review it to ensure accuracy. Check for errors in your personal information, income, deductions, and credits.

Conclusion

Now that you’ve read through this comprehensive guide, you have a solid understanding of the I-9 tax form and its requirements. By following the guidelines outlined in this article, you can ensure compliance with I-9 tax regulations and maximize your tax refund.

Remember to keep accurate I-9 tax records and adhere to the retention period to avoid potential penalties. Pay close attention to deadlines and compliance requirements to avoid any issues down the line.

Completing the I-9 tax form may seem daunting at first, but with the instructions provided in this guide, you’ll be well-equipped to navigate the process with ease.

I-9 Tax FAQ

#1. What is Form I-9?

Form I-9, officially known as the Employment Eligibility Verification form, is a document used by employers to verify the identity and employment authorization of individuals hired for employment in the United States. It is a requirement of the Department of Homeland Security, Department of Labor, and Department of Justice.

#2. When must an employer complete Form I-9?

An employer must complete Form I-9 for every new hire for employment in the U.S. This form is used to verify both the identity and employment eligibility of the newly hired employee.

#3. What documents are needed to complete Form I-9?

New employees must present documents that establish their identity and employment authorization. The form lists acceptable documents, such as a passport, driver’s license, and social security card, issued by the Department of Homeland Security, Department of State, and Department of Justice.

#4. Who is an authorized representative to complete Form I-9?

An authorized representative, as defined by Immigration and Customs Enforcement, is a person or organization designated by an employer to act on their behalf to complete Section 2 of Form I-9. This representative should be someone who can verify the employee’s documents and sign the form on behalf of the employer.

#5. Why is it important to complete and retain Form I-9?

Completing and retaining Form I-9 is crucial for employers as it serves as a record of employment eligibility verification for individuals hired for employment. It is a requirement imposed by the Department of Homeland Security and Immigration and Customs Enforcement to ensure compliance with U.S. immigration laws.